Business

Denver Housing Market Faces Historic Low Sales as Activity Surges

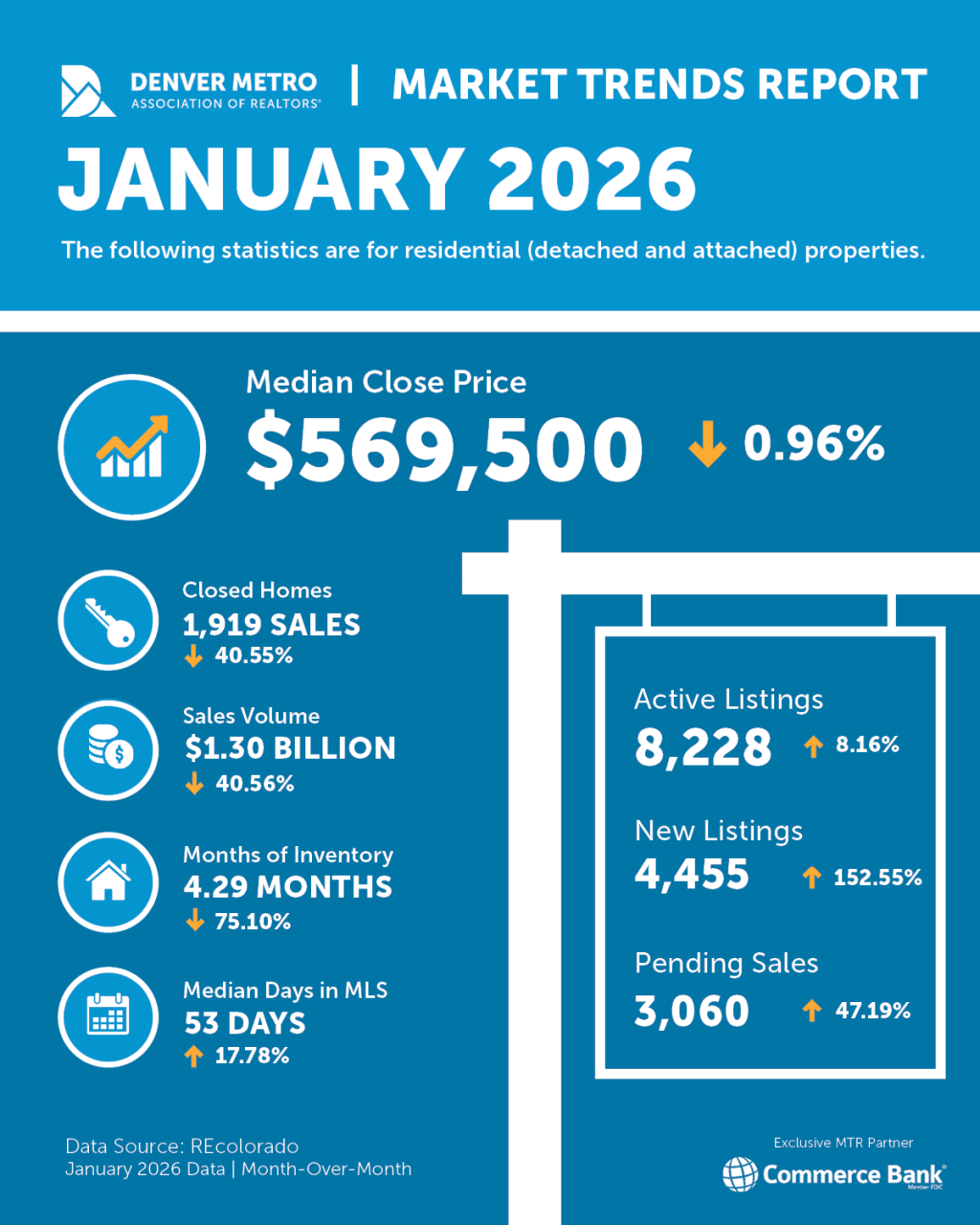

The Denver Metro housing market recorded its slowest sales month in almost two decades, with only 1,919 homes sold in January 2026. This figure ranks among the weakest since the financial crisis of 2008, with previous slow months occurring in January 2010 and January 2011. While this downturn is concerning, it stems from a prolonged period of market exhaustion rather than an outright collapse.

Over the past three years, the housing market has struggled to regain momentum following the post-COVID reset in 2023. Prices have remained stagnant, and both buyer and seller activity has diminished as participants await a significant shift in conditions. Buyers express fatigue over high interest rates and limited inventory, while sellers grow increasingly restless as their homes sit on the market.

Unexpected Activity in January

Despite the sluggish overall sales, January brought surprising developments, according to the Denver Metro Association of Realtors (DMAR). The number of new listings surged by approximately 153% compared to December, as sellers reintroduced homes that had been removed from the market during the holiday season. Buyer interest followed suit, with pending sales for detached homes rising by 48% and by 44% for attached homes.

Some of this uptick can be attributed to seasonal patterns, but the increase occurred earlier than usual. Favorable weather conditions, including unseasonably warm and dry days, likely encouraged both buyers and sellers to return to the market sooner than anticipated. Nevertheless, home prices continued to show softness, with the median sale price for detached homes decreasing by 4% year-over-year and attached homes declining by 2%.

As buyers become more discerning, negotiations have intensified. The close-to-list ratio has dropped to 97.9%, down from 98.5% a year prior, indicating that sellers are starting to concede to buyer demands.

Inventory Increases and Market Dynamics

January also witnessed a rise in active listings, reaching 8,228 properties, an increase of 8% from December and up 7% from the same month last year. This growth in inventory is atypical for January, a month when listings usually decline. More available properties provide buyers with greater negotiating leverage.

Amanda Snitker, chair of the DMAR Market Trends Committee, remarked, “The Denver metro typically has very predictable seasonality. Even though the last three years have been essentially flat in both home sales and the median sale price, seasonality is still apparent.” She advised potential buyers not to wait for a dramatic market shift, emphasizing that the best opportunities arise when personal and financial readiness align.

The luxury segment of the market presents a contrasting picture. Traditionally, the million-dollar-plus market remains dormant until mid-February. However, January 2026 saw a surge in detached luxury listings, which nearly tripled from December, with 594 homes hitting the market. Buyer interest in this segment also increased, with pending sales rising by 58%, resulting in 325 detached homes going under contract.

Conversely, the attached luxury market faces challenges. Only 12 condos and townhomes priced over $1 million went under contract in January, marking a decline of 25% from December and nearly 30% from the previous year. Homes priced between $1 million and $2 million currently have nearly 8 months of inventory, while properties above $2 million experience a staggering 26 months of inventory.

Colleen Covell, a Compass-Denver agent and member of the market trends committee, observed, “Detached luxury is showing real early-year energy, but the attached segment is clearly more price-sensitive right now. For condo and townhome sellers especially, strategic pricing and standout presentation will matter more than ever in a market with this much inventory.”

As the Denver housing market navigates these complexities, the coming months will be pivotal for both buyers and sellers as they adapt to ongoing changes and challenges.

-

Lifestyle2 months ago

Lifestyle2 months agoSend Holiday Parcels for £1.99 with New Comparison Service

-

Science3 months ago

Science3 months agoUniversity of Hawaiʻi Leads $25M AI Project to Monitor Natural Disasters

-

Science4 months ago

Science4 months agoInterstellar Object 3I/ATLAS Emits Unique Metal Alloy, Says Scientist

-

Top Stories2 months ago

Top Stories2 months agoMaui County Reopens Upgraded Lānaʻi Fifth Street Courts Today!

-

Entertainment4 months ago

Entertainment4 months agoKelly McCreary Discusses Future of Maggie and Winston in Grey’s Anatomy

-

Science4 months ago

Science4 months agoResearchers Achieve Fastest Genome Sequencing in Under Four Hours

-

Business4 months ago

Business4 months agoIconic Sand Dollar Social Club Listed for $3 Million in Folly Beach

-

Politics4 months ago

Politics4 months agoAfghan Refugee Detained by ICE After Asylum Hearing in New York

-

Business4 months ago

Business4 months agoMcEwen Inc. Secures Tartan Lake Gold Mine Through Acquisition

-

Lifestyle4 months ago

Lifestyle4 months agoJump for Good: San Clemente Pier Fundraiser Allows Legal Leaps

-

Health4 months ago

Health4 months agoResearcher Uncovers Zika Virus Pathway to Placenta Using Nanotubes

-

Health4 months ago

Health4 months agoPeptilogics Secures $78 Million to Combat Prosthetic Joint Infections