Business

SEC Retracts Crypto Lawsuits as Trump Returns to White House

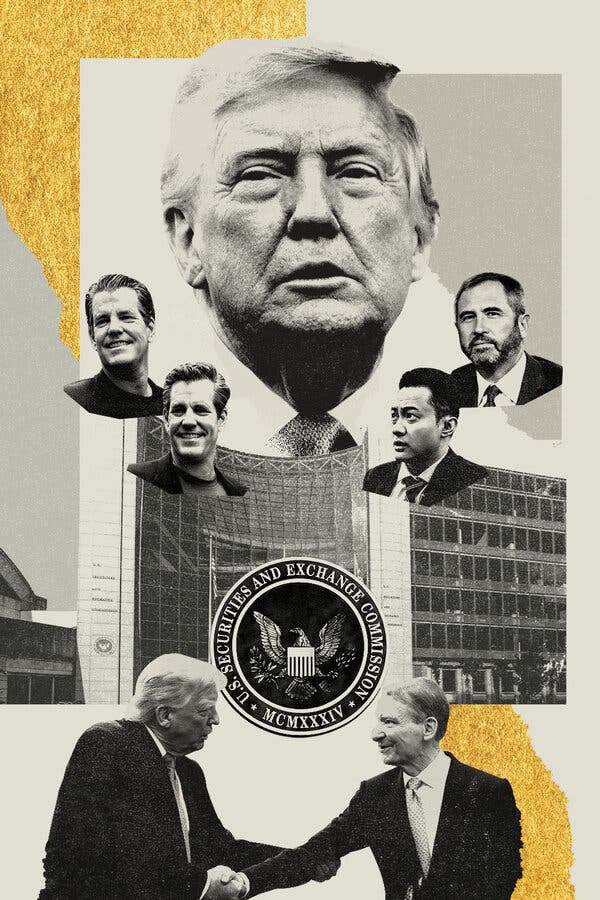

The Securities and Exchange Commission (SEC) has significantly altered its approach to cryptocurrency litigation following the return of Donald J. Trump to the White House. A recent investigation by the New York Times reveals that the agency has moved to freeze lawsuits against various crypto firms, including one involving the Winklevoss twins, founders of the cryptocurrency exchange Gemini. This shift marks a notable departure from the SEC’s previously aggressive stance on the crypto industry.

In the wake of Trump’s return, the SEC has re-evaluated its legal strategies, pausing litigation or reducing penalties in more than 60 percent of ongoing cases related to cryptocurrency. This includes the withdrawal of a lawsuit against Binance, the world’s largest crypto exchange, which was initiated prior to Trump’s second term. Additionally, the agency has sought to lessen a court-mandated penalty against Ripple Labs, further indicating a trend towards leniency.

The New York Times found that dismissals of crypto-related lawsuits have occurred at a rate far exceeding that of other industries during Trump’s tenure. This unprecedented retreat by the SEC is particularly striking, as the agency has historically maintained a firm stance on financial regulation. Under Trump’s first administration, the SEC initiated approximately 50 cases against crypto entities, while the current administration has seen no new crypto lawsuits filed to date.

In stark contrast, the Biden administration initiated over 105 cases against crypto firms, highlighting a stark divergence in regulatory philosophies. The SEC’s recent actions under Trump suggest a more favorable environment for cryptocurrency companies, which some analysts interpret as an effort to support an industry that has garnered significant financial backing from Trump-affiliated investors.

The implications of these changes may extend beyond legal outcomes, potentially affecting market confidence in cryptocurrency regulations. With the SEC easing its grip, many within the industry are closely monitoring how this regulatory landscape will evolve. As the situation develops, it remains to be seen how investors and companies will respond to this shift in enforcement priorities.

The SEC’s transformation regarding cryptocurrency litigation underscores a broader trend in regulatory attitudes towards the sector. Observers are keenly aware of the potential impacts on future policies and enforcement actions, particularly as the cryptocurrency market continues to grow in prominence and complexity.

-

Science1 month ago

Science1 month agoUniversity of Hawaiʻi Leads $25M AI Project to Monitor Natural Disasters

-

Science2 months ago

Science2 months agoInterstellar Object 3I/ATLAS Emits Unique Metal Alloy, Says Scientist

-

Science2 months ago

Science2 months agoResearchers Achieve Fastest Genome Sequencing in Under Four Hours

-

Business2 months ago

Business2 months agoIconic Sand Dollar Social Club Listed for $3 Million in Folly Beach

-

Politics2 months ago

Politics2 months agoAfghan Refugee Detained by ICE After Asylum Hearing in New York

-

Business2 months ago

Business2 months agoMcEwen Inc. Secures Tartan Lake Gold Mine Through Acquisition

-

Health2 months ago

Health2 months agoPeptilogics Secures $78 Million to Combat Prosthetic Joint Infections

-

Science2 months ago

Science2 months agoMars Observed: Detailed Imaging Reveals Dust Avalanche Dynamics

-

Lifestyle2 months ago

Lifestyle2 months agoJump for Good: San Clemente Pier Fundraiser Allows Legal Leaps

-

Health2 months ago

Health2 months agoResearcher Uncovers Zika Virus Pathway to Placenta Using Nanotubes

-

Entertainment2 months ago

Entertainment2 months agoJennifer Lopez Addresses A-Rod Split in Candid Interview

-

World2 months ago

World2 months agoUS Passport Ranks Drop Out of Top 10 for First Time Ever